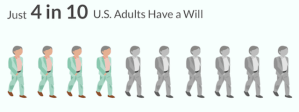

An alarming but not at all surprising statistic, is that more than half of Americans do not have any estate plan in place, should they unexpectedly pass away or become incapacitated. In a recent online article at caring.com, the author cites a 2017 Princeton Survey Research Associates International survey reflecting that only 42% of U.S. adults have estate planning documents such as a will, a trust, or a power of attorney. Some money quotes from the article, which is well worth reading in its entirety provide:

According to a new Caring.com survey, only 42 percent of U.S. adults currently have estate planning documents such as a will or living trust. For those with children under the age of 18, the figure is even lower, with just 36 percent having an end-of-life plan in place . . .

The study, conducted in January by Princeton Survey Research Associates International, asked 1,003 adults whether they currently have estate-planning documents in case of their death, as well as the reason why not (if applicable).

Forty-seven percent of survey respondents without estate documents said, “I just haven’t gotten around to it.” This is unsurprising to experts, who say an aversion to end-of-life planning is not only rooted in fear but also procrastination . . .

As one might expect, older Americans are the most likely demographic to have an estate plan in place. According to the survey, 81 percent of those age 72 or older have a will or living trust. However, that percentage declines significantly with younger people.

A staggering 78 percent of millennials (ages 18-36) do not have a will. Even more surprising is that 64 percent of Generation X (ages 37 to 52) doesn’t have a will, and nearly half of respondents in the 53 to 71-year-old age group (40 percent) said they don’t have one.”

Again, I recommend that you read the entire article. If you are one of the adults in this survey that has no estate plan in place, 2019 is a great time to start one. We offer free, in person, one on one, no obligation initial consultations to answer your questions about estate planning and offer suggestions on what might work best for your circumstances. Email me at anytime with any questions if you would like to set up an appointment at guy@guymurraylaw.net.

#jointtenancy #jointtenants #nipomo #nipomolaw #nipomolawyer #probate#nipomoprobate #nipomotrusts #nipomowills #trustsandestates #trustlawyer#probatelawyer #personalinjury #triallawyer #trusts #wills #estateplan #powerofattorney#healthcaredirective #estateplanning #digitalassets #advancedirective #revocabletrust